In the Know: Historic Tax Credits

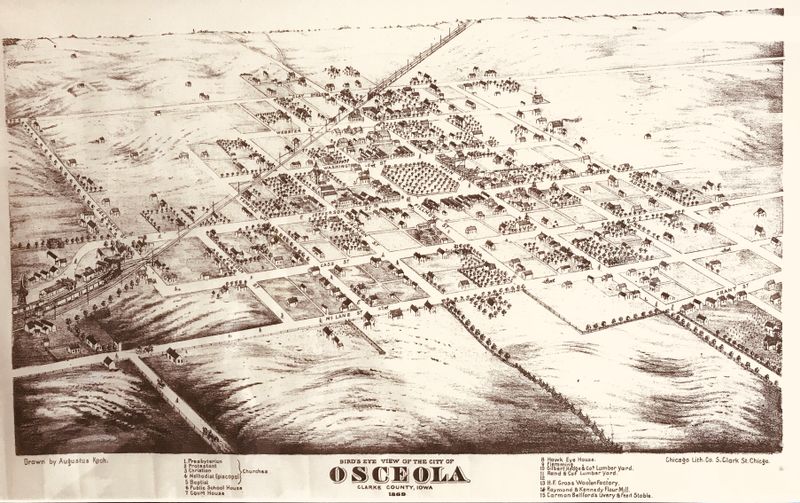

A local historic district is an entire area or group of historic structures deemed significant to the city's cultural fabric that are protected by public review. January 19, 2018, Osceola’s Downtown Commercial District was added to the National Registry of Historic Places. One of the perks of this designation is historic tax credits for business owners in the district.

Historic Preservation Tax Credit Program:

The State Historic Preservations and Cultural & Entertainment District (HPCED) Tax Credit Program provides a state income tax credit for the sensitive, substantial rehabilitation of historic buildings. It ensures character-defining features and spaces of building are retained and helps revitalize surrounding neighborhoods. The program provides an income tax credit of up to 25% of qualified rehabilitation expenditures (QREs).

The State of Iowa Historic Tax Credit Program consists of six mandatory steps:

Part 1: Evaluates the buildings integrity and significance and project eligibility.

Part 1.5 Pre-Application Meeting: Offers feedback that will enable you to prepare better applications for the Part 2 submittal.

Part 2: Evaluates that the proposed rehabilitation work meets the Secretary of the Interior’s Standards for Rehabilitation.

Part 2B Registration: Evaluates submitted materials for the project’s planning and financial readiness.

Agreement: Establishes the terms and conditions that must be met to receive the tax credit and established the estimated amount of the tax credit.

Part 3: Evaluated that the completed work has met The Secretary of the Interior’s Standards for Rehabilitation and that all other requirements of the agreement, laws, and regulations have been met.

20% Tax Credit:

A 20% income tax credit is available for the rehabilitation of historic, income-producing buildings that are determined by the Secretary of the Interior, through the National Park Service, to be “certified historic structures.” The State Historic Preservation Offices and the National Park Service review the rehabilitation work to ensure that it complies with the Secretary’s Standards for Rehabilitation. The Internal Revenue Service defines qualified rehabilitation expenses on which the credit may be taken. Owner-occupied residential properties do not qualify for the federal rehabilitation tax credit. learn more: https://www.nps.gov/tps/tax-incentives.htm

What to Know:

- The amount of credit available under this program equals 20% of the qualifying expenses of the rehabilitation.

- The tax credit is only available to properties that will be used for a business or other income producing purpose, and a “substantial” amount must be spent rehabilitating the historic building.

- The building needs to be certified as a historic structure by the National Park Service.

- Rehabilitation work must meet the Secretary of the Interior’s Standards for Rehabilitation, as determined by the National Park Service.

For more information about grants, tax credits and services available through Chamber-Main Street, contact the office 641.342.4200 or email [email protected].

.jpg)